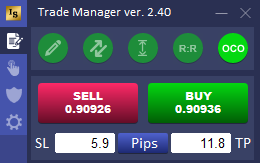

OCO (One Cancels the Other)

A one-cancels-the-other order (OCO) is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled.

After activating the OCO function, Trade Manager “remembers” all pending orders and when one of them is activated, the rest are deleted.

WARNING! Removing one of the orders does not cancel the other ones, but only activation the pending order will do it.

Drawing and clearing lines (open, stop and target) is on the one button

After drawing the open, stop and target lines on the chart, the pencil icon changes to an eraser icon that can be removed from the chart.

When the lines are removed from the graph, the button icon turns back to a pencil.

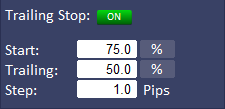

Trailing stop: activation parameter as% of distance to TP and parameter trailing as protection of% of earned profit.

Trailing stop Start can be set as% of distance to TP, e.g. if TP = 30 pips and Start = 75% then trailing start after 75% of 30 pips = 22.5 pips

Also “Trailing” parameter can be set as% of earned profit, so let’s back to our example:

TP = 30 pips

Start = 75%

Trailing = 50%

when the trailing stop is activated at 22.5 pips profit, the stop will be moved to a distance of 11.2 pips, which protects 50% of the current profit (50% of 22.5 pips)

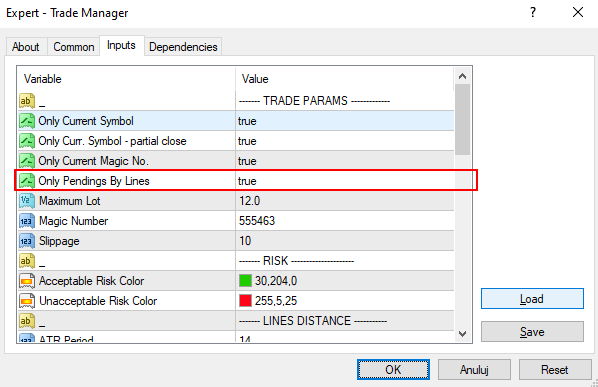

Ability to disable button to open market orders when lines (open, stop and target) are drawn on the chart (pending orders only)

In the Trade Manager settings window, you can disable the possibility of placing market orders when the lines are drawn on the chart:

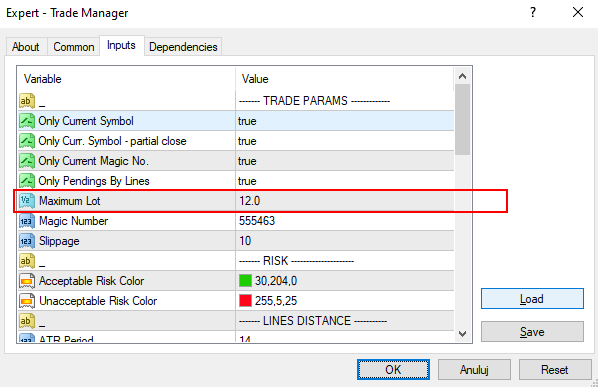

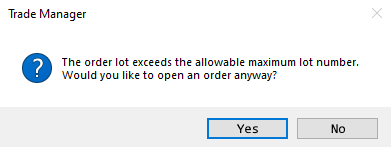

Ability to set max. lot size. If this size is exceeded, a warning message box will appear.

In the Trade Manager settings window, you can set max. allowed lot size.

If you want to place an order and the lot is greater than the one set in the parameters, a message appears asking if you really want to open such a large order:

New items displayed on lines

Display on the lines the amount value in the account currency of the stop and target without cents using the tags ::sl_rcurr and ::tp_rcurr

Display stop and target as a % of the account balance or equity using tags

::sl_bpct i ::tp_bpct -% of the account balance

::sl_epct i ::tp_epct -% of the account equity

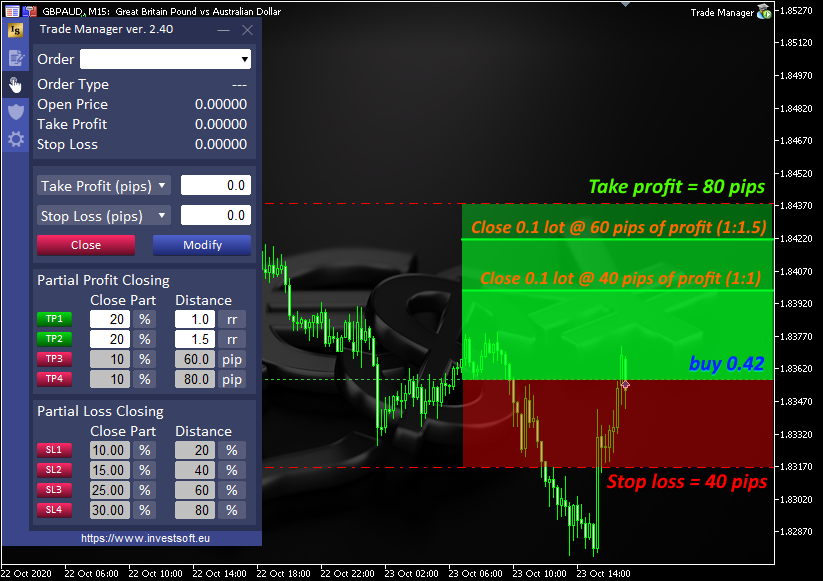

The 3rd option for setting the distance of partial order closing and breakeven activation: Risk Reward (rr)

Break even offset as% of earned profit (“Profit” parameter)

As in the case of trailing stop, we can set the “Profit” parameter for Breakeven as a percentage to protect, for example, 25%, 30%, 45%, etc., of the already earned profit, i.e. as in the example below:

Break even will be activated after 50 pips and the stop will be moved to 5 pips (protection of 10% of earned profit).