Hello TPA traders,

thank you for your patience, to wait for the promised blog about trading with TPA True Price Action 2.0 and TPA Sessions indicator !

As we are no pro marketers, it took a while to handle all the work and preparing. We created a whole new view on the charts instead. Out of seven years of trading experience and the conclusion, that mainstream teaching and trading, leads to nowhere. There must be something simple, nobody is talking about…

Quick recap, what TPA is all about:

TPA (and TPA 2.0) is not another fancy indicator with a fancy algorithm trying to place some arrows up and down.

It mirrors the victory of the fight between the bears and the bulls when it happened, without repainting or lagging, in a certain amount of time.

Please remember to ask yourself all the time:” Who is control, the bulls or the bears ??

Therefore, candle by candle can be traded as additional trades and not just a breakout or other mainstream entries.

So this is the real deal in the real world of marketmakers in all markets.

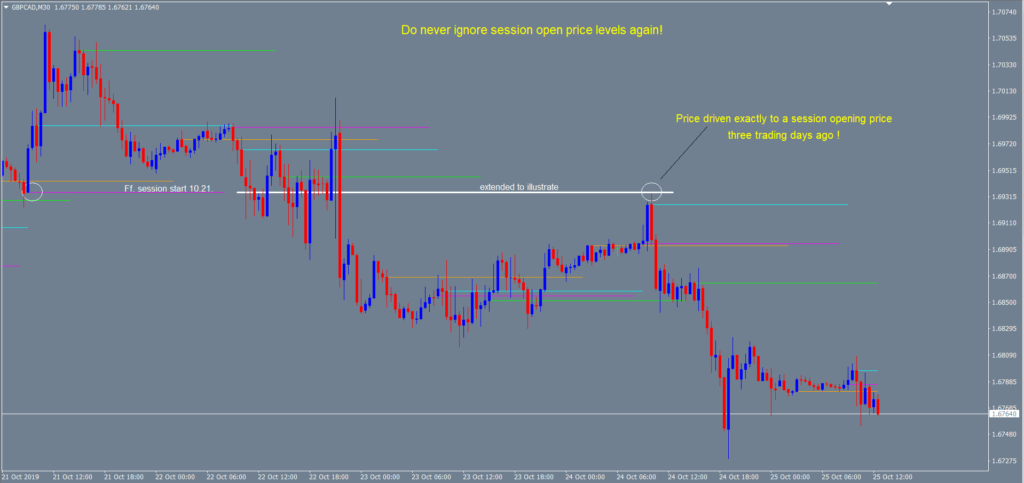

The same reality, as session opening prices attracting them, during the day, or days later.

What does that mean, the “victory” and arrows and dots, when it is called “price action” ?? Usually nothing, but candles are to see on the chart.

The “victory” after each candle, dictates even the big boys, where market is going. They need direction too, to generate their profit.

The arrows and dots, and now a TPA Line in TPA 2.0 are necessary, to make you “see the true price action” on your chart. You can make them all invisible and go just by the alerts, if you like. The filter TPA Line helps to not get caught in every little counter trend move and market changes direction for a short period of time. No filter means ALL signals, no lagging because of a setted period, just pure, raw price action.

Ascending and descending signals are like “footprints in a snowy, remote area” you can follow. If you decide to “not fight against the marketmakers, just follow them”.

Every trader knows, that marketmakers like to leave “misleading footprints” and so we have to deal with it , as good as we can, even in consolidation!

Here is the TPA trading instruction manual : (more to come)

- Check the current trend, determined by the TPA Line. Up, down, sideways? Is there a consolidation in current or in a higher timeframe (not or hard to trade)?

- Is the trend strong, determined by the slope of the TPA Line?

- Are there ascending or descending signals in sync with the TPA Line (all colors, when no filter)?

- Check the overall trend in a higher timeframe, (H1, or higher, set to 50) at least once a day!

- Look for CONFIRMATION signals by TPA, when session opening prices are touched and rebound OR after the break of session opening prices!

- Look out for TPA Session lines from a day before or more too, as targets or maybe end of the move!!!

- Settings for overall trend: TPA Line active, H1 set to 50. 50 because the pros are using this timing tool since decades and most of them define the trend with it and NOT with higher highs and higher lows (up) !!! H1, 50, can be used for trading in lower timeframes AND the next higher, as the TPA Line is displayed there as well! H4 and D1, 50 for longterm trend of course.

- Settings for trend: TPA Line active, set to 21 (a reason for default) in any timeframe. Both, 50 and 21, active, showing signals in trend direction only?

- TPA Line set to 50, 21 or any other setting, but NOT “active”, shows still the TPA Line, but with ALL signals produced by the marketmakers !!! In both directions! True Price Action shows, where you STILL can follow ascending/descending signals in sync with the TPA Line.

- Please consider to reduce your traded pairs or instruments to a fraction, to not get overwhelmed by so many reentry-signals. That way, you reduce stress, but increase profit, by adding up trades, or “scale in” your trades!!!

Disclaimer: All on our blog is no trading advice, just a way, TPA could be used. You are trading at your own risk.

Monday, October 21th.

Hello everyone,

here, some pictures about the instruction manual and some facts.

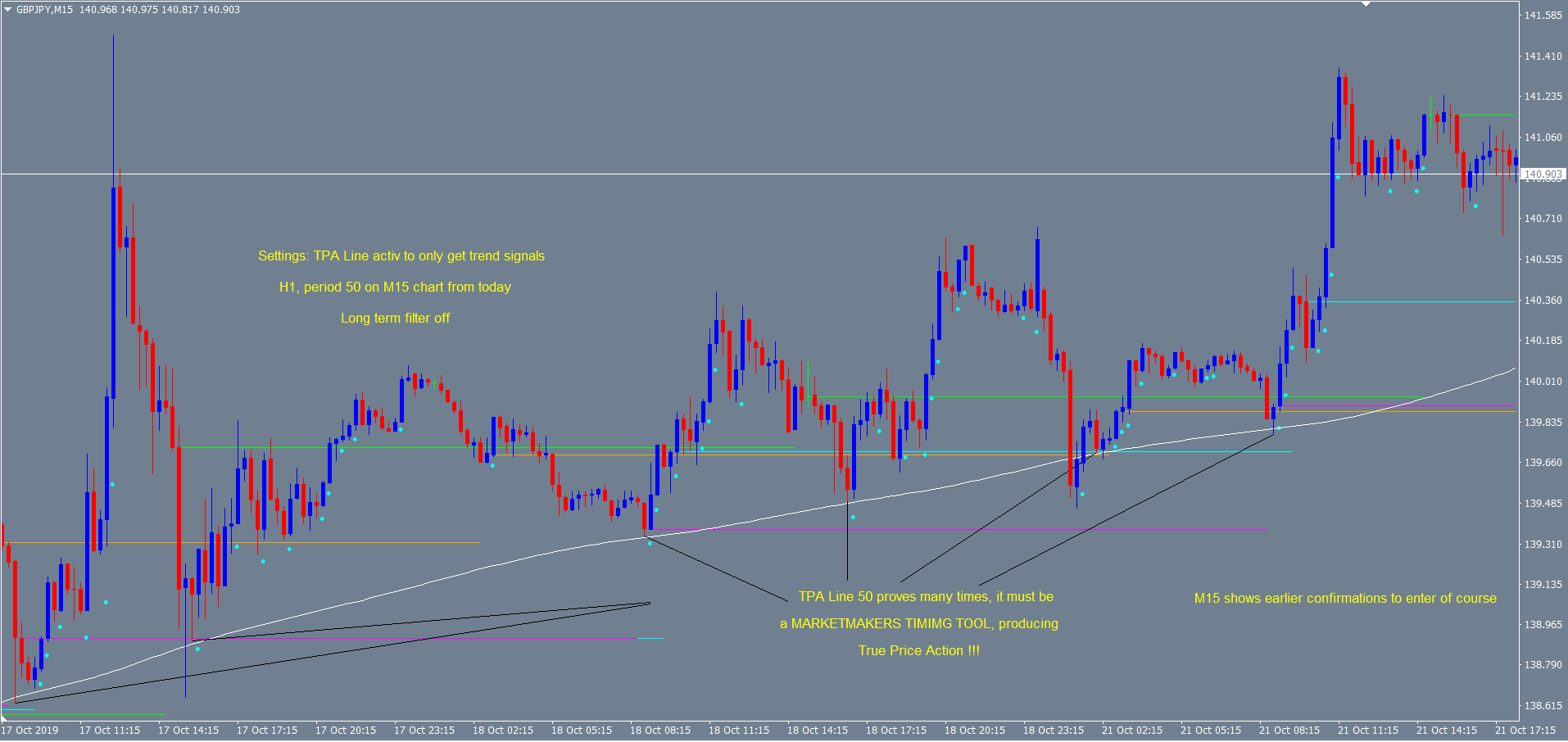

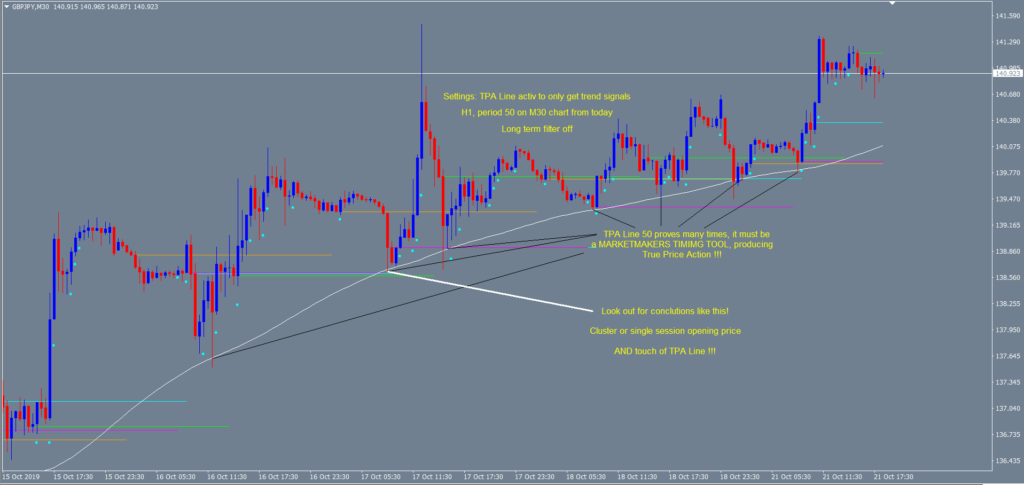

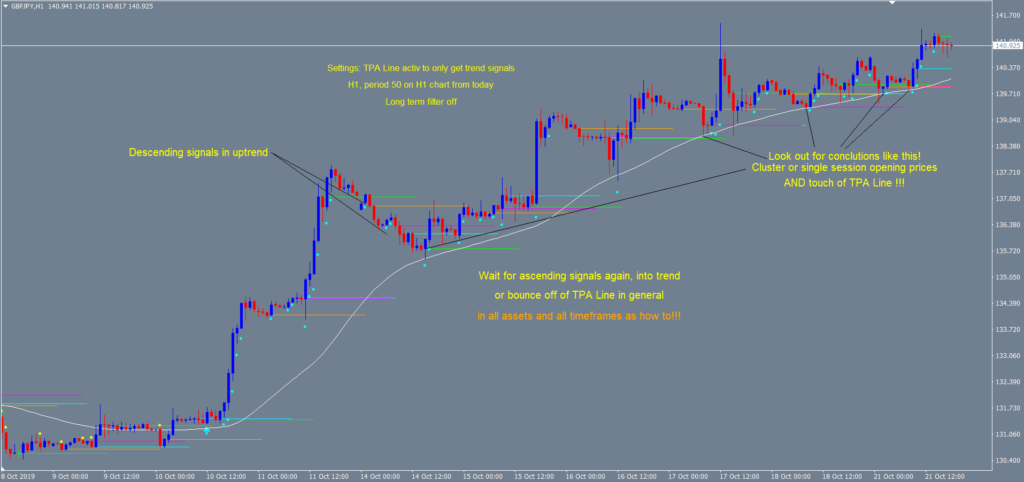

The settings, TPA Line active, long term filter off, period 50 on current, one or two timeframes higher, are very, very important and profitable, if you check the manual and pull the trigger, of course. Please take a look.

As you can see, even a “slow” setting of 50 (marketmakers are using this period for timing since decades and you can see, it is true) shows the trend, the trend strenght, by it`s slope and filters out countertrend moves, or “discount” moves, to convince traders, moving in “their” direction, reaching goals.

Now imagine, even for 5 minutes, you do not need “volume interpretation”, no subwindow indicator bouncing between 0 and 100, no fancy “holy grail indicator from a guru”…

…and come to the real deal, marketmakers are producing every day, in every asset and every timeframe….

“Who is in control, the bears or the bulls?” Do not fight them, follow their “footprints”. Compare different timeframes. Get earlier entries and more reentries, the smaller the timeframe, you trade.

If TPA Line is activated, consider to use fibonacci numbers as periods! They are important for timing too, not only for price levels, mainstream is teaching!

So 5, 8, 13, default 21, 34 next to 50(no fib) can be very profitable in every timeframe, in every asset or instrument !

Example and another interesting feature of TPA is:

Using those settings on M30, but active TPA Line is set to M15. That way, you see what is going on in the next lower timeframe ! Or a daily chart, but 21, H4 !

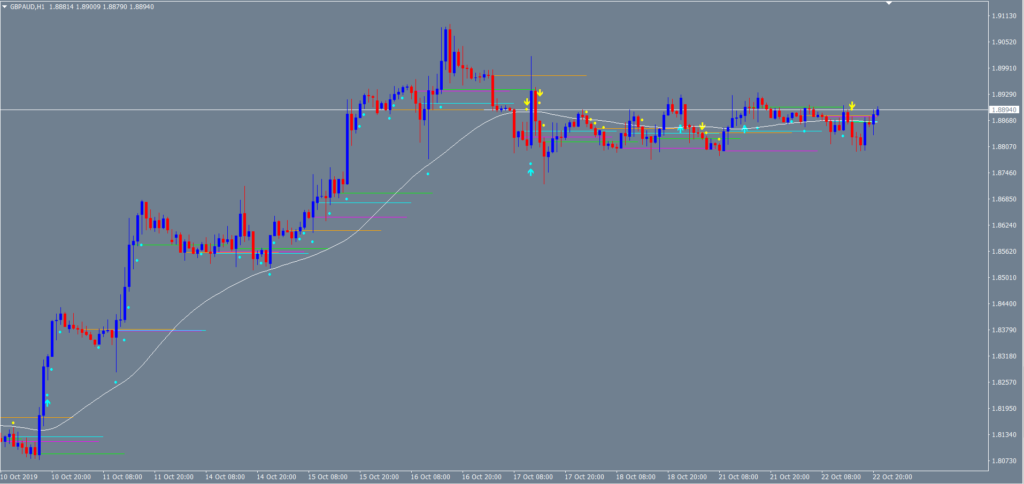

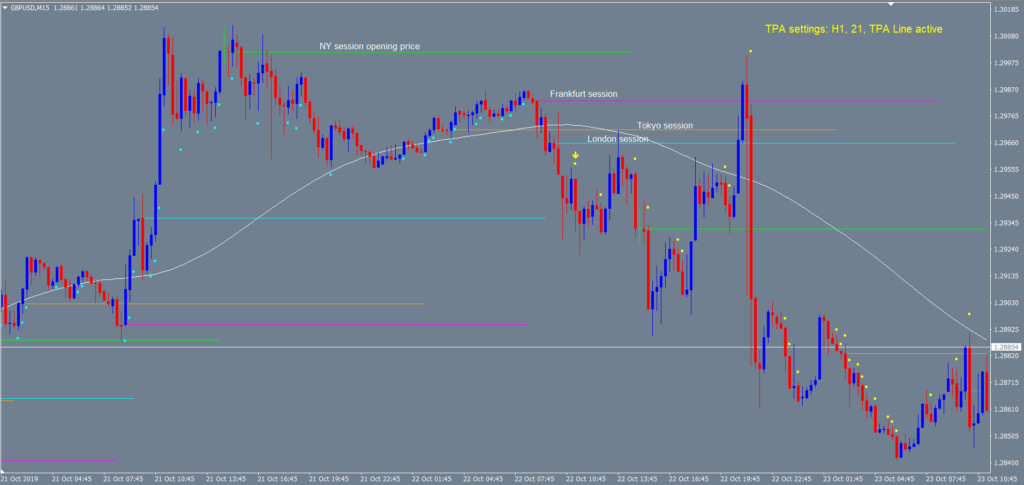

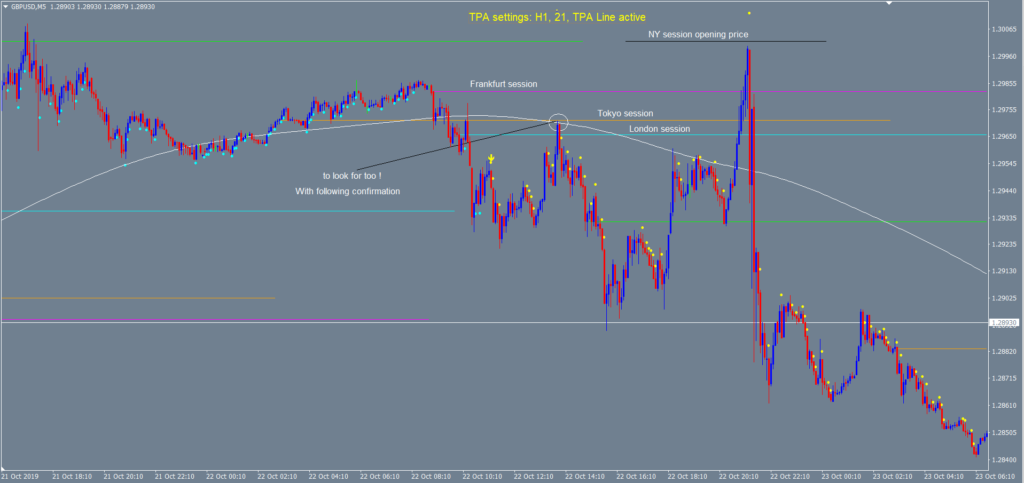

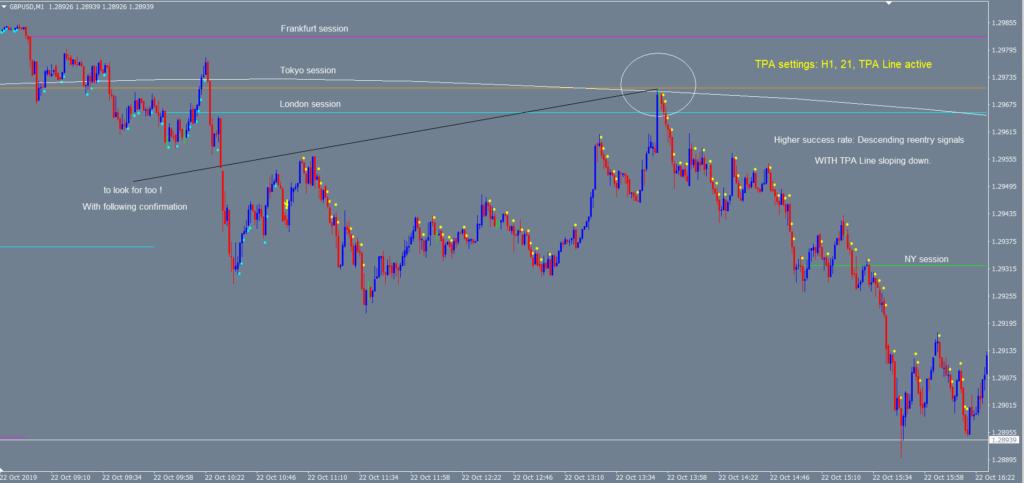

Here is a picture from today with a “not so beautiful” trend. Please take a look, how TPA sessions combined with TPA True Price Action, even in this situations, support your decisions. Point 6 of the instruction manual is truly profitable!!!

This one is the same picture, but M15 with TPA Line from M5. That way, you can see the TPA Line from the lower timeframe, in the higher timeframe. Less signals of course, as they only appear at the close of a candle.

This is the overall trend H1, TPA Line activ, 50 H1, long term filter off. Trend went into sideways motion, but on the lower timeframe, with faster settings, profit can still be made.

Wednesday, October 23rd

A “must read” review from the very experienced, but not paid (sorry… :-), customer “Speedbug” !

https://www.mql5.com/en/market/product/39932#!tab=reviews

What about Binary Options ?

Binary Options are definitely to trade with TPA and TPA sessions, too !!

A question, from one of our customers “Igonah” on mql5, trading binary options with 5 minutes expiry, answered like this:

Open a M15, a M5 AND a M1 chart with settings: TPA Line active, H1, 21. The M15 chart, to see the overall trend at a glance, where marketmakers are and what they are doing throughout a day or two. NO alerts on !

The M5 chart, same as above, NO alerts on !

The binary options trading (scalping forex of course too) happens at the M1 chart. Alerts ON ! Compare all three charts, look how price is moving towards and away from the sessions opening prices. Check confirmations by TPA reentry signals. Bring ascending/descending signals in sync with the slope of TPA Line !

.

.

Friday, 25th of October

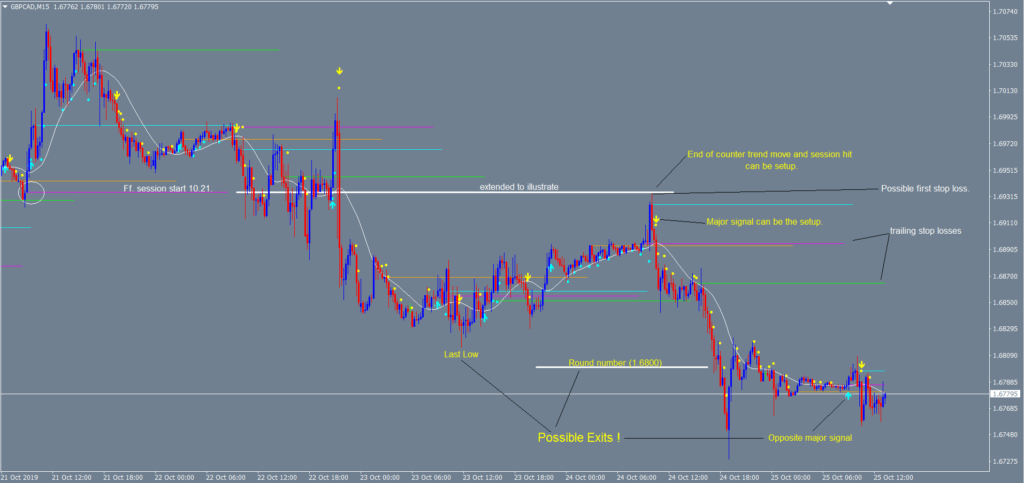

An example of how a trading setup could look like:

Of course are major signals (arrows) with or without filter (TPA Line) active, the first choise. But “reading between the lines” (literally when TPA Sessions is used ;-), session opening prices can be the trade setup too.

Take profits (targets, exits) can be:

- A certain amount of pips. In trending pairs like GBP pairs, more than in less trending pairs, like EURUSD. So please take a look around, if you do not trade those trending pairs.

- A past (or more) session opening price level(s).

- The last high/low.

- A round number.

- The opposite major signal, either you are trading true price action without any filter, or with TPA Line active.

Stop Loss(es) can be:

- A recent session opening price level, which can be “cheaper” than the last high/low.

- The last high/low, when there is coincidence with a session opening price, may it actual or three days old. (Please do always keep an eye on older lines).

- Trailing stop loss to new session opening price levels (with buffer).

Please take a look at this example. (To illustrate only)

.

As with our respected customer Simon communicated:

Consider trade setups with other price action tools, like a trendline !!! Remember, that you have the best confirmation tool in your hands now! The marketmakers actions (who is on control right now?)!

If you have other usefull tools, or if you are working with “channels”, another price action tool, even better.

By the way: TPA True Price Action indicator works with HeikenAshi Candles too!!

.

Tuesday, 29th of October

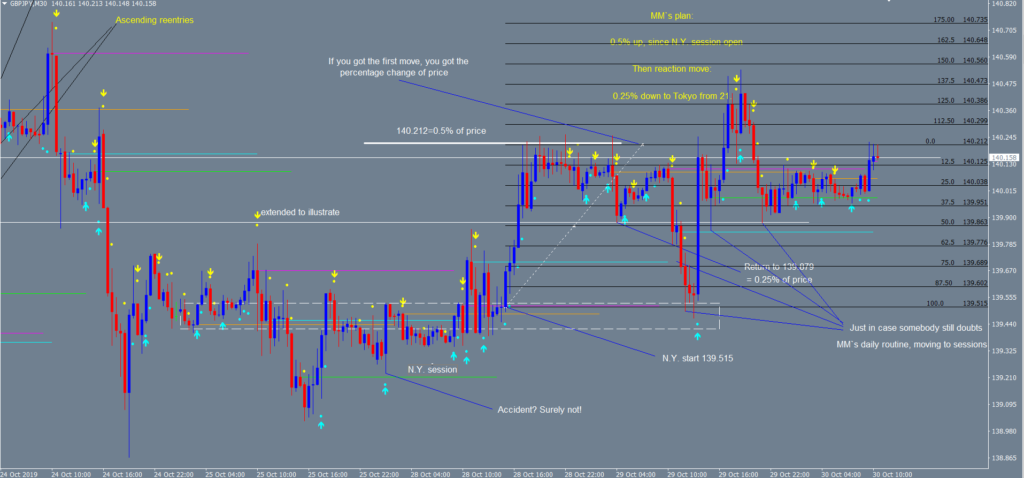

A actual picture, to show you possible setups, but most of all, that you are on the right track with TPA and TPA Sessions indicator.

TPA settings: Hide TPA Line, current (M30), 5, active (fast setting, but still filtering).

You can find a bit more about it here:

https://www.forexfactory.com/showthread.php?t=946318&page=2

.

Same picture, a day later, without filters, zoomed in. Hard to trade, but this one is for a different view at the markets, you may find helpful.

The “percentage” tool is standard in your MT4 and called “fibonacci drawing”, but changed from fibonacci to percentage. To a “price action tool” if you will.

.

Thursday, 31 of October

Something about Gold.

.

Tuesday, 5th of November

Hello again,

due to many questions about TPA and TPA Sessions, I would like to clarify some important points and the SIMPLENESS of TPA.

Please do not over-complicate the most simple facts you see, when TPA True Price Action indicator is on your chart.

TPA was invented and coded to finally let go mainstream teaching, talking heads trying to sell expensive trading courses and let trading look like rocketscience to have a “right to exist”.

What do you think the “carved out of stone” hearsay is comming from: “95% of all retail traders will never make it”

It is just because trading HAS to be impossible to the small people. But wait a minute, there is only two ways a price can go, a four year old can follow “footprints in the snow” or a stupid line on a “computer game” if it is going up or down, right?

I very much apologize for not being clear enough and not good enough teaching about TPA in the last weeks.

It was because I was sure, everybody can see at a glance, how much potential TPA has, once it appears on the chart.

So here are very, very important things, you HAVE to know AND to understand:

— TPA True Price Action`s core is to use it WITHOUT any filter, to see in real time, without repainting or lagging, what marketmakers are doing and where they are haeding in real time. (after candles close, to get a save information of course).

— Without filters, you can “kind of” catch tops and bottoms, by confirmation signal of TPA. Trendline tool of MT4 is recommended, or channel tool, or TPA Sessions indicator. I mean confirmations of rebound and/or breaks .

— You NEVER can catch tops or bottoms with a filter on, nowhere in trading!

Because of the periods you set. Periods always mean, “after the amount of periods”.

Filters are profitable when you know what they do and use them that way.

— Filters on TPA are a kind of “extra”, made to filter out noise, small or big pullbacks DURING a trend, AFTER the turn happens.

The pros talking about “Cut the tail and the head of a fish and enjoy the meat in the middle”.

If the slope of TPA Line is still steep, but marketmakers try to trick you with a lower low and a lower high for example, trend is still intact, proved by the next TPA signal into trend direction of the TPA Line.

— The long term filter of TPA can be combined with the short term filter “TPA Line” but is mostly not necessary, as the periods on the short term filter, can manage your trading style.

— I am sorry to say: NO, TPA is no magic weapon against losing some trades.

There is nothing you can do about the actions of the marketmakers dirty game with money, a lot of money.

If the markets are “flat” or a “mean” move to stop you out in a text book trend.

Some “footprints” they leave, will cost you money.

Not fair to claim something else !!!

Please take a look at the following picture and let go mainstream thinking for a while and look for the simple logic marketmakers are practicing and how you can follow with TPA and TPA sessions.

This one is a “extreme” setting example, just to make you “reading between the lines”.

No, not between the TPA session lines. 🙂

I realy hope I could make some points more clear and take away some confusion and fear.

The picture shows, how important it is to observe ascending or descending siganals, in this case only one color (for short) and bring them in syncronisation with the trend of H4, when trend is traded and not the counter trend move.

Please have a look what TPA traders say:

https://www.mql5.com/en/market/product/39932#!tab=reviews

Best Regards

The TPA team

.

Wednesday, 6th of November

Hello TPA traders,

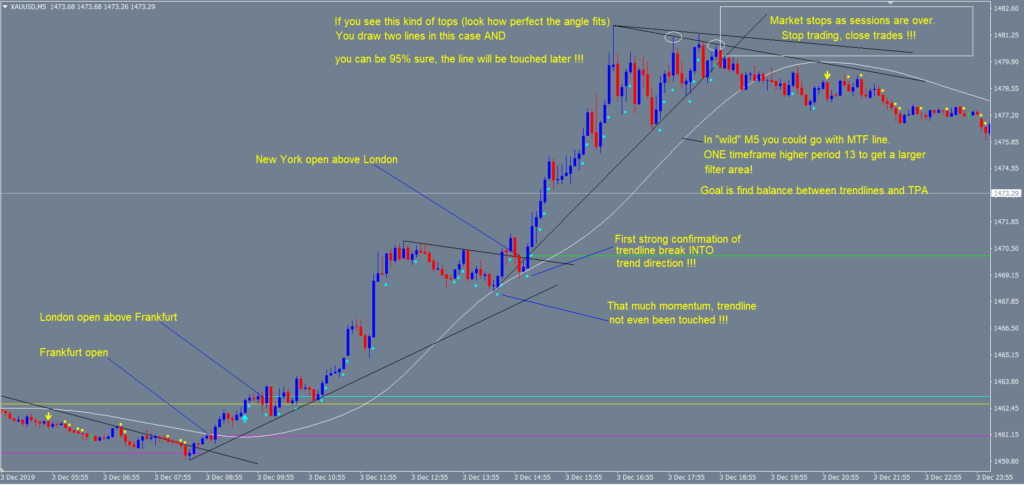

here are some interesting settings on Gold, M5.

Possible way to trade TPA.

No matter what timeframe, every time a candle closes as a dominant candle, in this case bearish, a reentry signal and a alert of your choise appears. Pop-up messag, Email or notification. How and when, you handle this, is your personal trading style and choice.

To not use this extreme trend example shameless as a “wonder weapon” against all negative aspects of trading, a realistic scenario is drawn, to illustrate a traders every day schedule.

Important is also, that when a sideway phase ends and marketmakers decide to start “moving” long or short, you can start to follow them too. Either with the first entry signal right away (arrow), or if you do not trust the first move of the marketmakers, after the second “confirmation” signal (dot).

.

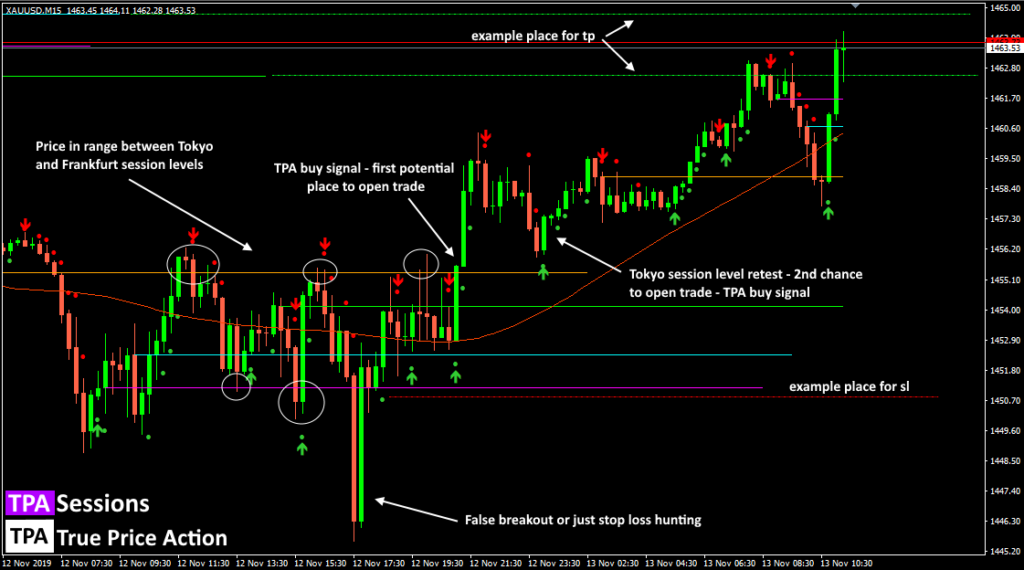

Wednesday, 13th of November

Hello TPA traders,

Another great example of TPA trading on Gold, M15.

Yesterday afternoon we could observe on gold how price bounces off Tokyo and Frankfurt sessions levels.

Please take a look how TPA lines becomes more and more flat in this stage.

In the some moment, price broke down and quickly retuned to range. It was a typical market maker’s trick called false breakout or stop loss hunting.

After this, price returned to range and went to the upper band. In this time TPA Indicator generated BUY signal. This is the first opportunity to open trade. In the next step price returned near Tokyo sessions level and made retest. Before price breakout, Tokyo level was an resistance (price bounced off this level a few times) but after went over this level this is a support level. This is the 2nd chance to open buy trade after the TPA indicator’s signal.

Initial stop loss (to protect account) and take profit can be set in many ways. It is all personal decision and trading style.

In this example potential stop loss can be placed below Frankfurt sessions level and take profit can be set at the previous New York or London sessions levels.

With such placing of stop loss & take profit you can have risk reward ratio at least 1:1 or even 1:2 what is important to keep positive result of your trade series in the long term.

.

Friday, 15th of November

Hello traders,

if you read all about TPA and TPA Sessions on the threads on FF and here on our blog, you know already that you are in the middle of “2,000 $ trading course”…but free of cost !!

If you are new here and just don`t have the time to read for hours, grasping the pictures, the trades with explanations and all the important insides about overall trading, you could read the following and use it as a personal checklist.

A checklist, nobody can help you with, to answer, because everything in your life is your decision and your personal attitude !

In my almost eight years and more than 15,000 charthours (TPA and TPA Sessions were born from), I learned, that trading is by far the hardest reflecting activity I ever did, when it comes to the truth about myself, my attitude, my decisions.

Yes, I am ashamed, that I was so brainwashed by the mainstream thinking and teaching about trading, and wasted so many years and money, to find out by myself, this is not the way I can ever make it in trading.

Your checklist:

# 1 (with a huge distance to all following) What is better for me, for my freedom of time and for my financial freedom ?

Following the “Smart Money” (marketmakers, large banks, institutions)…or…the “Non-Smart-Money” ???

(realy thinking to make it with “freebies”, cheap “robots” and “signal-services” or study (buying expensive courses) outdated “Classic” technical analysis, based on oscillating indicators, possibly adding several up, to get “insurance”.

# 2 Is trading nothing more than a “Game” for me…or did I make the decision (!) to be a serious trader making enough money to have a good life ???

# 3 Do I understand and accept, for myself, that it is better for me, to not fight the “Smart Money” and join them instead ???

Which would be the opposite of following the “Non-Smart-Money”!

Can I put away my illusions about the market, my approach so far. Can I let go expensive “traditional” training programs?

Can I “refresh” and open my mind, to see, what marketmakers are doing?

Will I ever accept, that trading is certainly not easy, but no rocket-science either, like “they” try to sell me ?

For those, who are already working with TPA and TPA Sessions:

# 1 Can I “systemize everything” ? As I am not sure “what”, “when” and “how to” trade.

Yes, you can! No matter “what”, no matter what timeframe, but certainly “when” (sessions with momentum), you “could” for example use strictly (!!!) only one setting, no matter what, (if market is flat, go away, of course, it is a part of systemize)

You could trade all entries plus reentries in this “filtered area”. Example: Timeframe “xy”, TPA Line active, Long term filter off, periods 8, current.

Put on those settings and observe the past of your traded (better good trending ones) pairs or other assets.

Check out, what “the filtered area” looks like, and where price “hits” or “crosses” the sloping TPA Line. This “exits” all trades, either by touch, or close behind that line.

If market keeps on trending later into the same direction….get back in….systemize it.

Observe “wider” and “tighter” settings (filtered areas), to find YOUR style to systemize everything.

You MUST know, beginner or not, when something is systemized, you have to accept losses, you will not win all, but way more than losing in healthy trending markets. Can you accept this fact ?

This is just another, of many ways, you can join the “Smart Money”, to follow the marketmakers.

Please remember: This is all for education only, it is not a trading advice. And it is free for you. You are trading at your own risk.

Do not over-complicate everything! Make your decisions.

Best Regards

The TPA team

.

Tuesday, 19th of November

Just in case you concentrate on this thread only, here is the answer a respected customers asks about M5 settings:

Hello Hawey!

Thank you for renting probably the last indicator you ever need! 🙂

To assure yourself, that this is not a gag, we will help you in the best way we can. But please notice, that we are not allowed by law, to give you certain trading advice.

Especially after “certain people” got a bit nervous about TPA.

First you “could” observe TPA on your preferred time frames and pairs, without any filter. Just pure and clean TPA in the past days, maybe weeks.

All alerts off, to not get disturbed, watching ascending and descending signals. Major signals with arrows and follow up signals, reentries with dots. TPA Line should not be visible at first.

To “manage” so many profitable (as they never repainted or lagged) signals, you just have to understand: This is the past, and while I am trading during the day, they help me, finding profitable setups for the next hour, or hours.

Then you “could” draw trendlines and observe, how price

bounced off or broke them and see how TPA confirmed such

happenings, to get the next step further, studying the past to

learn for the future.

You will quickly realize, that TPA without any filters, or visible TPA Line, has no “waiting for turns of setted filter periods”. This is “True Price Action” of the marketmakers.

Once you are familiar with this fact, you “could” add the

TPA Line and make it visible, but not “active”, to study

the pure TPA signals moving along with TPA Line, period

21 and (important), other settings to compare!

The next step “could” be, to activate the TPA Line, to compare

(maybe on a second, identical chart), what it means:

Pure TPA and TPA with activated TPA Line.

This is the best way, to dive into TPA and discover trading possibilities (not only the additional reentries), you never saw before.

Now that you are in this stage, please try different settings, even with the dropdown menu (“TimeFrame”) for MTF function, to understand, how your pairs “behaved” in sessions with strong momentum, in sideways, quiet times and how you can match those to your trading style and time to trade during your day.

Please remember, we are not allowed to give you trading advice and that you are trading at your own risk !!!

Best Regards

The TPA team

.

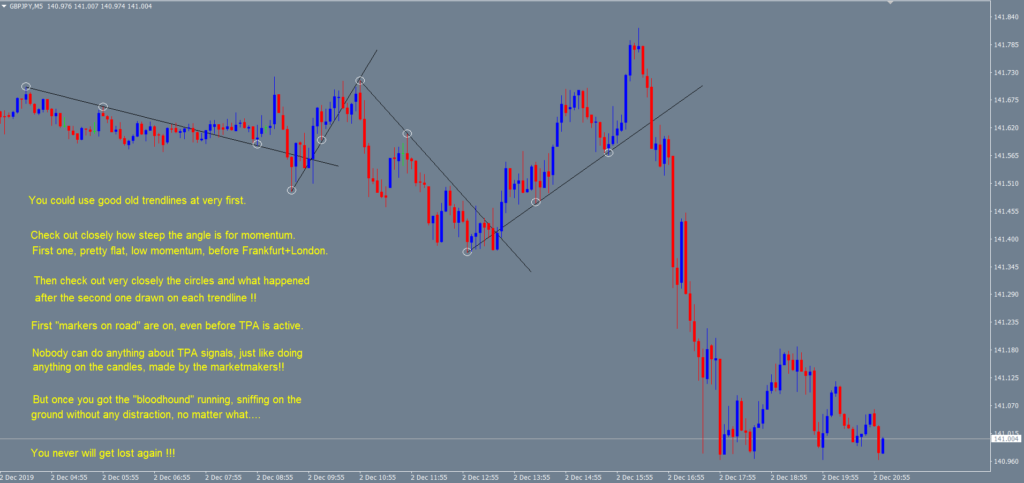

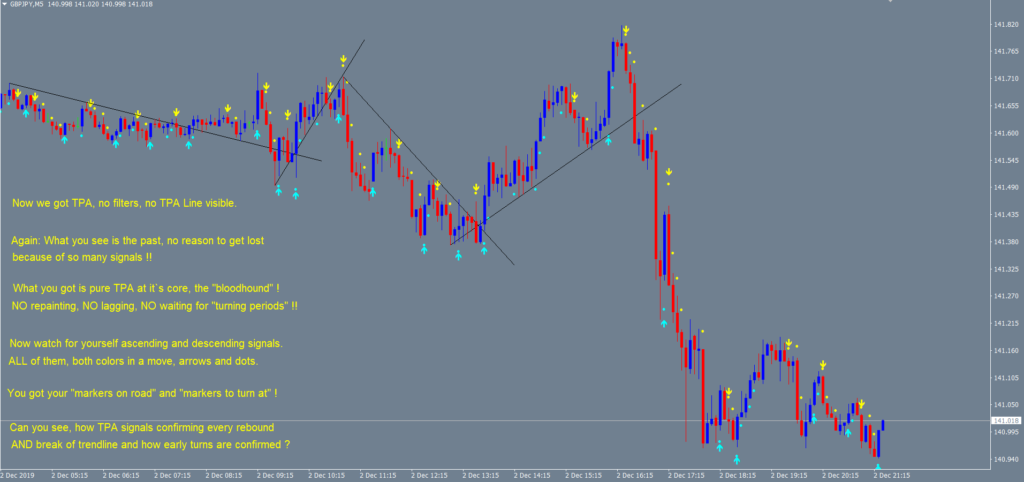

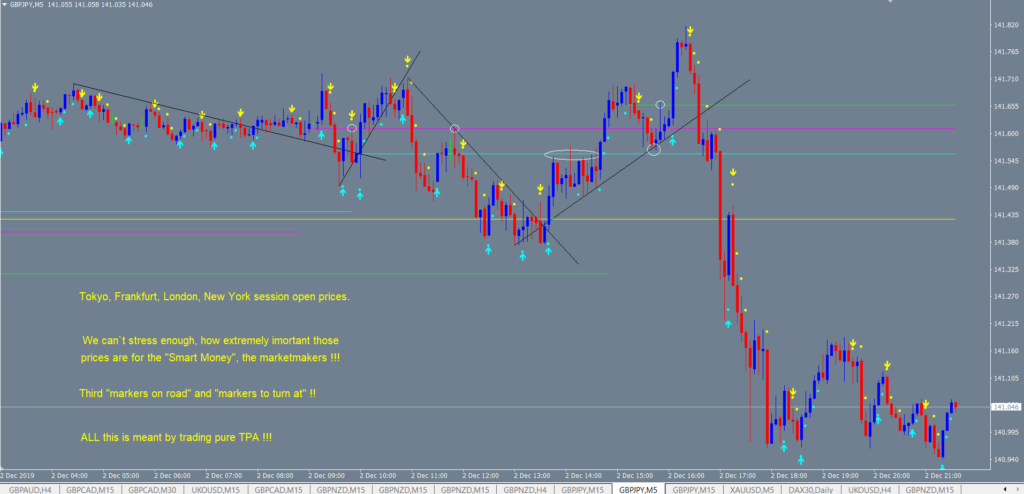

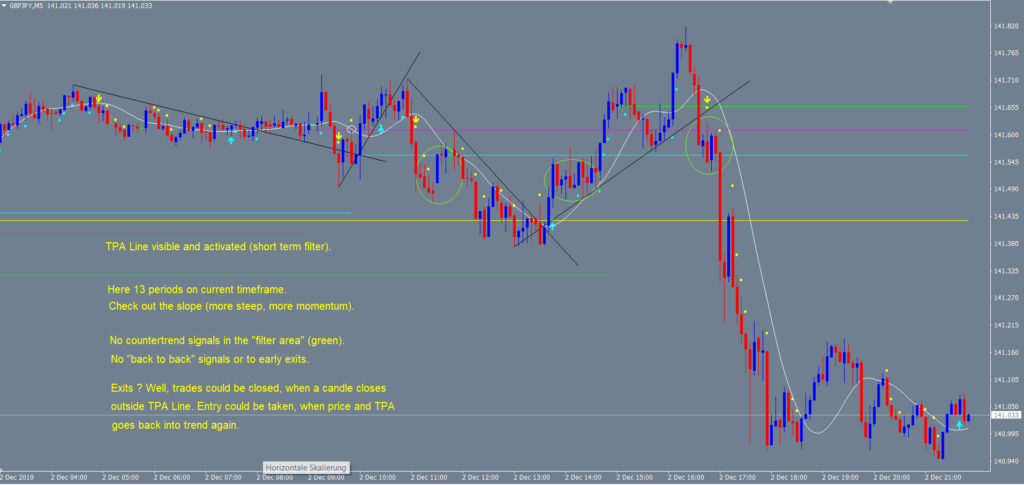

Monday, 2nd of december 2019

Here are pictures and very, very important informations about the

Dive into TPA …MANUAL !!!

If you have only 50 or 5,000 chart hours, if you bought expensive trading courses, if you are a believer in “free stuff only”…or if you are the luckiest girl or guy from all….just starting without a brainwashed mind by the mainstream and an “empty jar”….

YOU will be taking advantage of the following….

So, please, try to look at it, without constantly thinking about “candle stick patterns” six more indicators to confirm, what you see. Buying and dumping the next indicator and the next system…and the next strategie….

Please relax, open your mind and see, if you can be a “Smart Money” follower or not. Nobody will be forced to buy anything… you will only be forced to understand the clear view on the markets… 😉 .

OK: Please concentrate on ONE pair or asset (often and good trending) NOT THE worst trending, but at a cheap rate !

There is way enough to gain on one pair, you won`t miss anything, you only get lost in to many things to check, to many signals, to much STRESS !!!

Sounds familiar ? Well, that`s your first step TO COME TO YOUR SENSES !!

See, I told you, you will get forced !

And there you have it…the manual, to dive into TPA !

We really hope, you take advantage of our experiences, the conclution we came to.

Do not go that ugly and hard way of many years and a bunch of money wasting trip. Think about your job and how nice it would be to have freedom. Freedom of time and money. Nobody said trading would be easy, but it can be done, by leaving the mainstream and following the marketmakers, no matter what…

Best Regards

The TPA team !

.

Wednesday, 4th of December

Hello TPA traders,

especially during the last weeks, the “big question”, why do 95% of all retail traders never make money and/or quit, is getting more clear than ever before.

The answer to that question is so simple, so brutal, nobody wants to hear it, least of all, accept it !!!

Acceptance would be the key….but who is honest enough, strong enough to himself…??

Imagine this: There was a guy, of course not spending a dime on TPA, “DEMANDING” the best settings for his traded pair in such a arrogant and ignorant way (to extended explanations later also), that he won`t think one second, that he is the problem, not the market, or a indicator or a strategy.

Blaming everything and everybody else, but not himself, even there is a bunch of facts in the market, nobody can ignore or change…. Think about that !

Btw, such people will be ingnored in future and we will spend our time on serious and polite people, open to clean their brainwashed mind by the mainstream.

Again, nobody will get forced to buy anything, but trolls and haters will be dismissed.

Ok, back to the “dive into TPA” manual…Please do not look at it as “another brick in the wall” and go through it, step by step.

Or are you the 95% party, traveling your whole life for searching the holy grail ???

Do it that way: Work out for yourself, what definitely can NOT BE CHANGED, work out your own rules based on that !

Only then, you are on the right track. Certainly not, jumping and dumping from picture to picture, indicator to indicator, system to system.

So what can not be changed ? The candles can not be changed. The trendlines can not be changed (yeah I know, trolls know that better) and what happens after point 2 of the trendlines can not be changed.

The signals of TPA can not be changed either, as they are tracking the candles and NEVER REPAINT and NEVER LAGGING.

So far so good. Four things, that nobody can change, ignore, dispute or blaming for his failure.

Guys, this is not an “opinion”, this the market, this is a fact !!

So please, work with it, make yourself your own teacher. That way you accept it, use it.

The following pictures are for exercice (draw the lines ) about the “dive into TPA” and explains the “hated” words:

“Different market stituations require different settings!”

If you still and really think, in the trading industry will be an indicator with just one “magic” setting, solving all different kinds of market situations, you are indeed the party of the 95%.

Sorry, but trading is no “pink pony yard” with a few “unicorns” in the background… So stop moaning and blaming everything and everybody. Come to your senses.

Check out the “dive into TPA” manual again, draw your own lines, put on TPA in the shown order and teach yourself!

Make yourself a price action pro and let go the mainstream stuff, at least for a day. Nothing to lose, doing that.

.

What you see is BASIC price action turned into ADVANCED price action, made by TPA and accepting facts.

Again, this is not an “opinion”. Just facts.

Best Regards

The TPA team

.

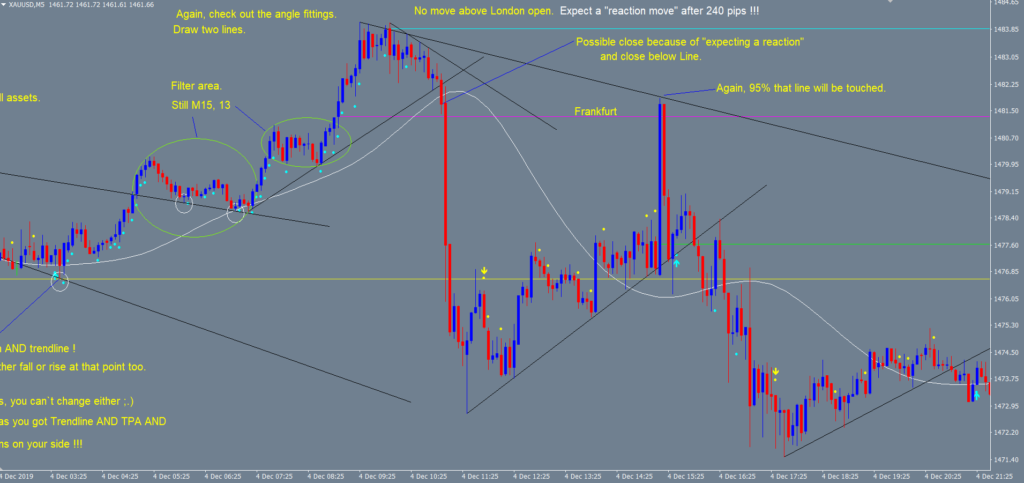

Friday, 6th of December

Hello everyone,

as Gold went on, the proof of the 95% probability and how trustworthy TPA works, can be observed now.

Questions like : “Ok, there are four things nobody can change, but what does it mean during my trading?”

“And what about sideways/flat markets ?” ….are very good and helpful to ask.

As the “dream trend” earlier is not cherry-picked and just the actual situation, the less beautiful phases have to be shown too.

If you are building your trading style on rock solid foundations, like “things nobody can change”, you have the only basis making sense (not only in trading).

Your risk/reward ratio cannot be better, following the stone cold facts ! Blink, if you agree.

The following picture, continuing the last post, can be transmitted to every other asset or pair. (Trendline technique and TPA performing)

Now you can see “flat” market and therefore the following of the TPA Line too.

Again, not an “opinion”, just facts, repeating over and over on all assets or pairs.

“Action and reaction move(s)” (good trend/s) are followed by “quiet, flat phases”.

Now please study the next picture, Gold going on.

Can you find out what nobody can change either? Or do you prefer to ignore the ugly side of trading and blame everybody or everything for

such a “profit killing move” (if the indications on the chart being ignored, like a huge move before, no move above London)?

Best Regards

The TPA team

.

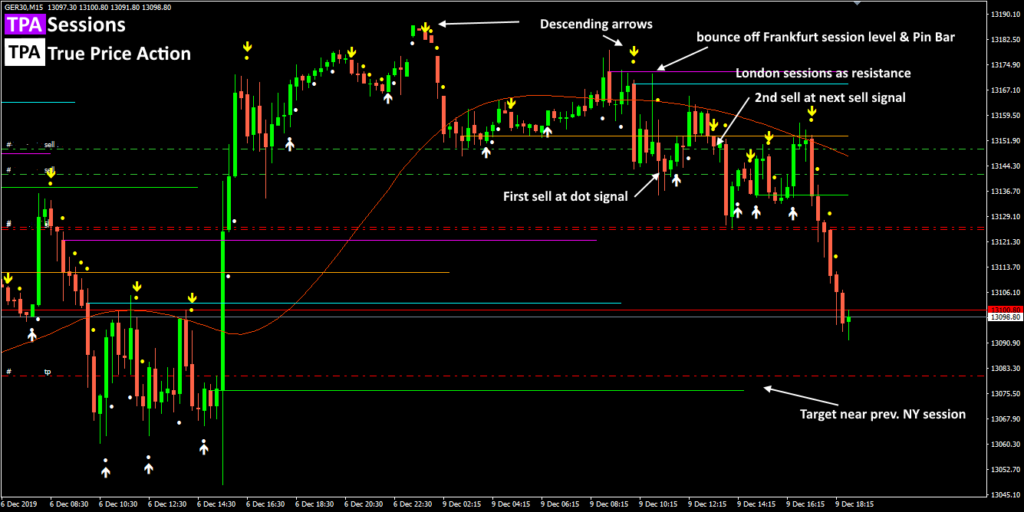

Monday, 9th of December

Great opportunity for sell trades on DAX today.

First of all, look at the sell candles at the today’s Frankfurt open and next London’s open. After Frankfurt opening price backed to the opening level and at the London’s open went lower. Next price once again test resistance level at Frankfurt opening level and closed much lower, drawing Pin Bar.

After this we have opened 1st sell trade at the TPA re-entry sell signal. After this, price tried to test London opening level but it was not able even touch this level what means that bears are strong. It was confirmed by TPA signal a few candles later, where we have opened 2nd sell order. Also the TPA line began to increase the slope down.

After NY opening, bulls tried to push price higher, but forces were enough only to reach the level of opening session in Tokyo, followed by a sharp drop in price.

Our two sell trades target is just before prev. NY sessions opening level.

.

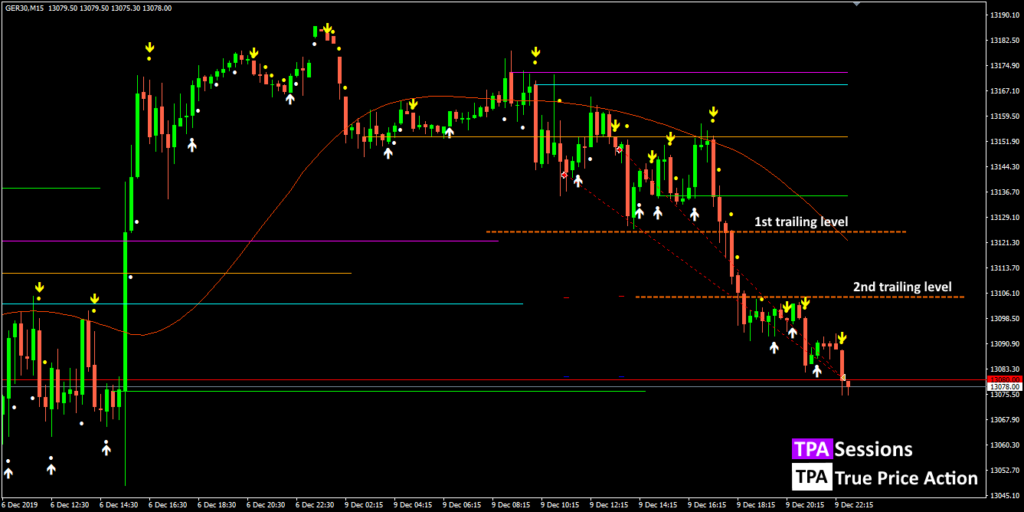

Update: 9th of December 22:15

Price hit our target and close both sell trades on DAX in profit.

After price drop below prev. London sessions level we moved stop near prev. Frankfurt session level to protect profits in both trades. When price dropped lower we moved stop just above last high (near prev. London sessions level).

.

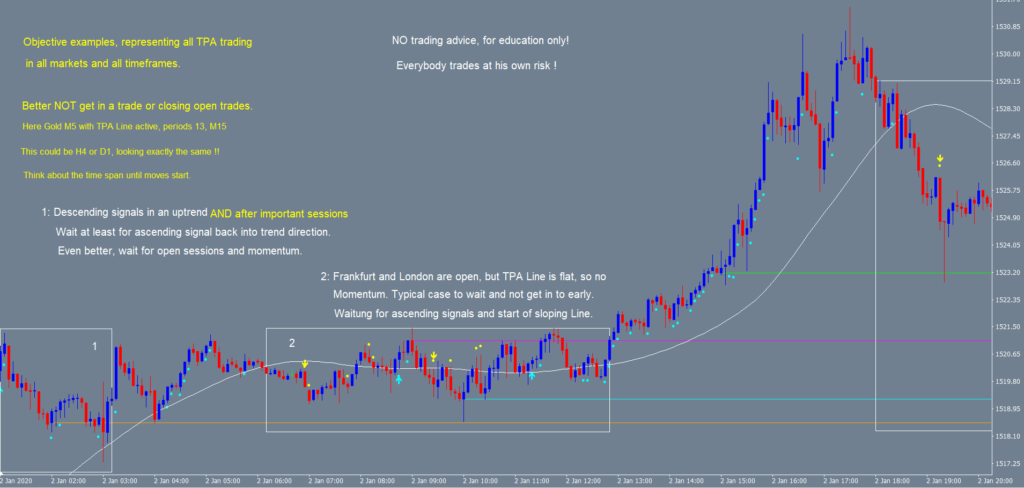

Saturday, 4th of January 2020

Happy new year everyone !!! 🙂

We wish you health, happiness and success in 2020 !!!

Let`s move on with some informations and educational stuff about TPA:

First of all, if you have some New Year`s resolutions, here is a good one:

Invest in yourself !

“What? Why are you saying this ?”

You won`t believe what people from all over the world wrote, to get a “get rich over night” answer from us, about TPA trading.

Mostly: “I am to lazy to read your blog” (not even this thread right here).

Or: “I don`t understand the manual and the step by step manual to dive into TPA”

Now please do not get this wrong, but….

…if you are not willing to invest in yourself, by reading, or studying even

this bit of stuff, you will never achive anything in your life.

I know, I know, truth hurts like nothing else, but you can overcome everything, if you only want to.

Remember, a friend tells you what you want to hear. Your best friend tells you, what you have to hear.

We will never met and you might say, why is he talking about “best friend”. Well, take it like “from the best friend in my mind”.

Invest in yourself and you will make this year the best you ever had….so far.

Ok, that being said, here is an excellent point, Chris, a “self investor” 😉 pointed out.

“I don’t know if thats just the way I think; but I am thinking the haters are taking ALL the signals not knowing what does not qualify. If you can make this clear you can then highlight why that trade should not have been taken. Because your indicator is totally unique to all other indicators there is no other reference as to how this works.”

Thanks for that Chris !

We had a conversation about haters, trolls and quitters (never ever self-investors) attacking TPA, our reputation, customers, who posted a positive review or comment and even mql5 for not refunding products, they can`t handle.

I prepared a few examples for education only, to point at some reasons, why a trade or blindly all taken reentries, should be avoided.

If a filter (in general in trading) is active, there is always a time span and a certain amount of candles (no matter what timeframe or asset), it takes to “turn” and get qualified signals into the other direction.

This is another fact, nobody can change.

Getting a lot of perfect and profitable signals during a trend, does not mean you will never get hit by your stop loss. Especially if you run small stop losses. So you have to watch out for “round numbers”, “a suspicious long run”, “support and resictance levels” and “session opening prices”, for example.

Please take a look at the following pictures and read between the lines, bring in your experience and common sense …invest in yourself.

.

.

.

.

“Reading between the lines” means, that you decide, how large the filter area is gonna be, by your settings.

This means, you create your own trading style by catching the start of a move earlier (faster setting, smaller numbers), or later (slower setting).

If you use slower (larger number) settings, you can clearly see, that you should not take every reentry on your chart (no matter what timeframe) as long the signals are descending in an overall uptrend. You have to wait for ascending signals again, matching the uptrend.

Rebounds of the TPA Line and/or a session open price, followed by a confirmation signal, is golden of course.

This “ascending and descending signals thing” looks and sounds way to simple to work out ??

Well, take a look by yourself…

If you prefer to get brainwashed by the mainstream and angry afterwards about your wasted time (years) and money (thousands) …

Think about the “invest in yourself” idea again.

Nobody can avoid a “whole week of testing” a badly choppy market and get losses. This is part of trading too and those phases are hard or even not to trade, for sure. Be flexible, do not stick to bad trending pairs or assets, just because they are “cheap”. Mainstream wants to push you, where “they” want and not where you want.

Best Regards

Wednesday, January 22, 2020

Hello everyone,

yesterday we started a “Telegram group” for TPA owners. If you like to join it, please send the purchase-line of “TPA True Price Action” from your mql5 account (to the left, “purchases”). You will get an invitation link within a working day, or right after the weekend. TPA renters will get support as usual via email.