Hello traders,

today we are starting to show you some TPA trades combined with TPA Sessions, including important explanations.

We would like to demonstrate the potential of TPA and TPA sessions to make you look at the markets in a different, more simple way.

Please remember, we are not providing trading advices, you are always trading at your own risk. This is just a way, TPA could be used!!!

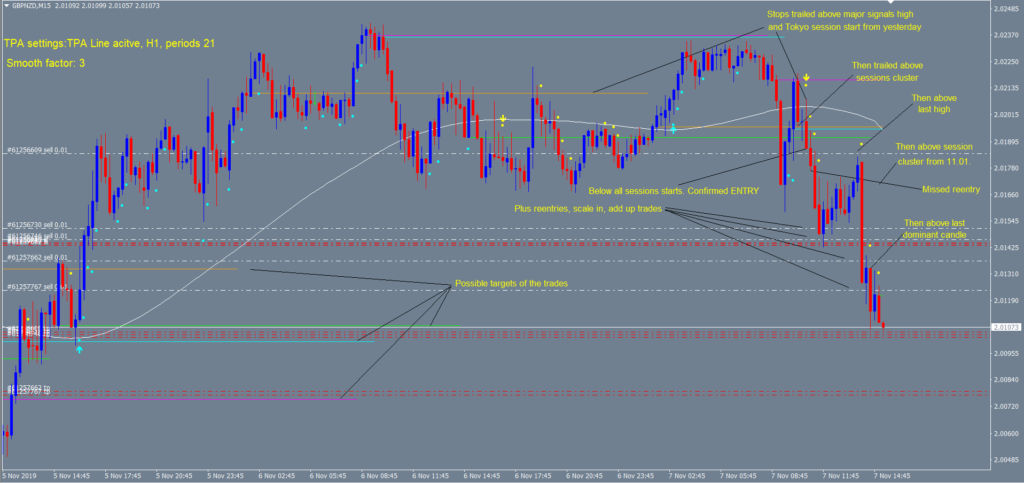

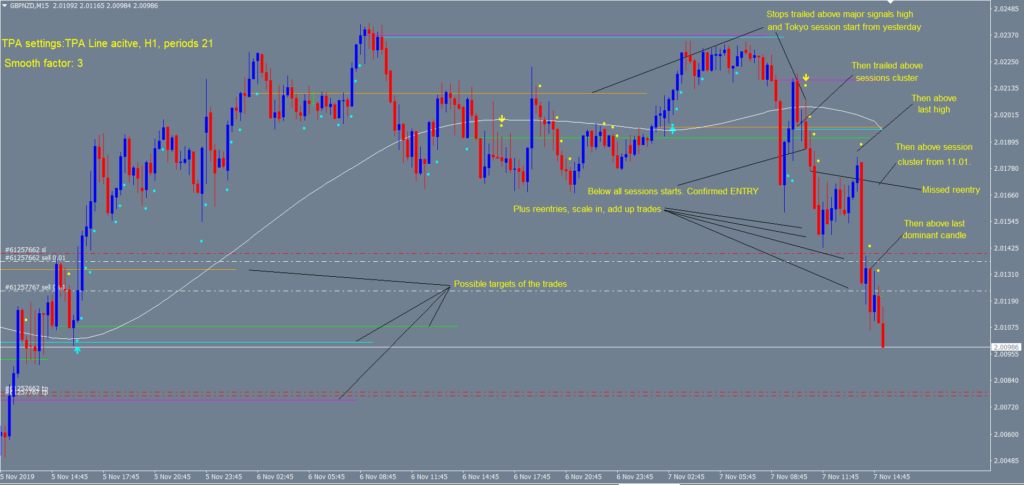

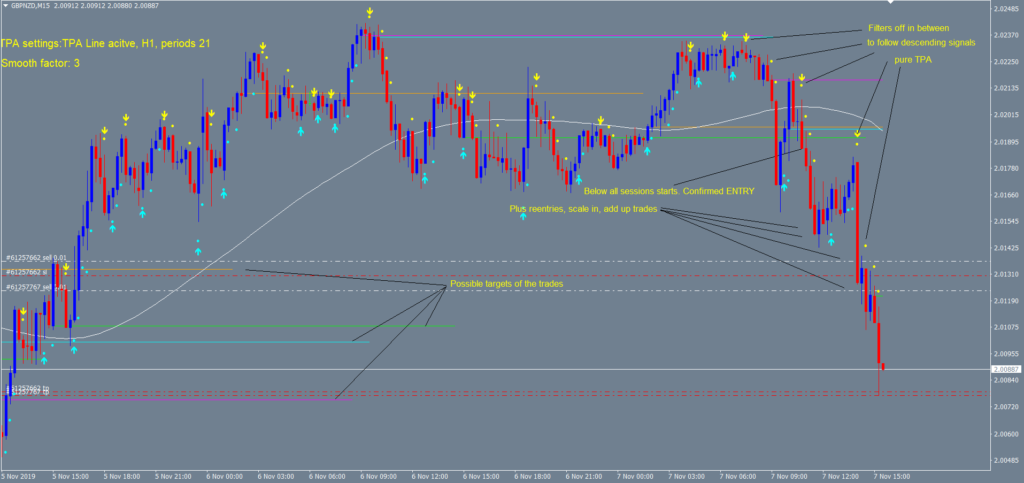

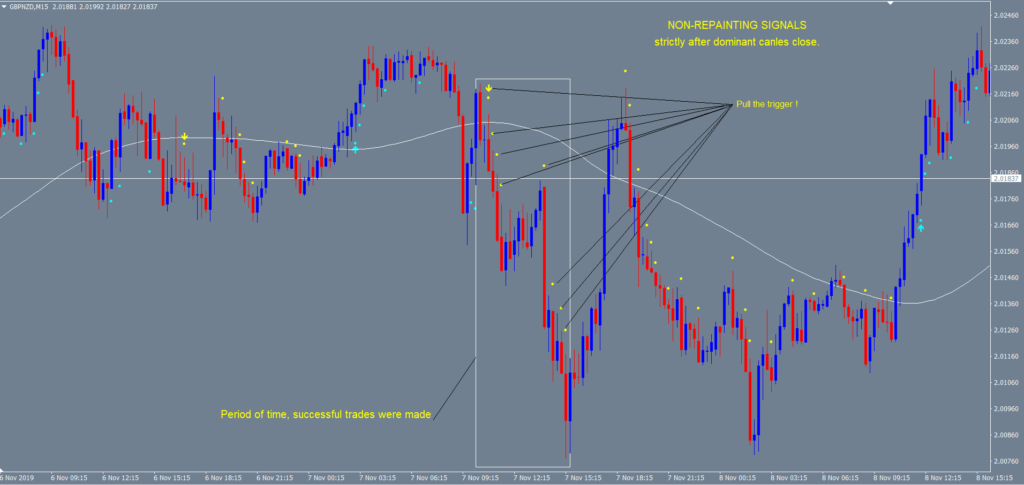

GBPNZD M15. Settings: TPA Line active (short term filter), H1, periods 21, Smooth Factor 3 (bit faster turns, than default 4)

Typical morning in europe, move starts even before Frankfurt session, pics up momentum (action move), then typical pullback (reaction move) back to Frankfurt open, to rebound and then the bears get back in the lead again.

Why not do that trading a day before? Because the slope of the TPA Line still determines an uptrend and that means, chances are high, that price is either more trending, or at least pull back and pause.

But this morning, price rebounds of Frankfurt and London session opening level from yesterday, made a first break to the south pulled back to Frankfurt and later a major signal (arrow occured) which confirmed the bounce of Frankfurt AND the break of three session opening levels.

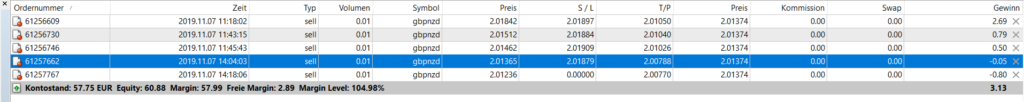

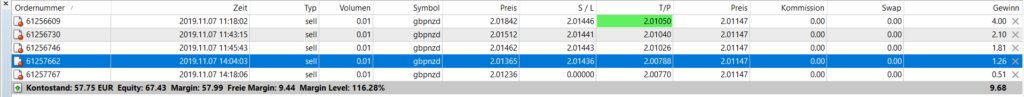

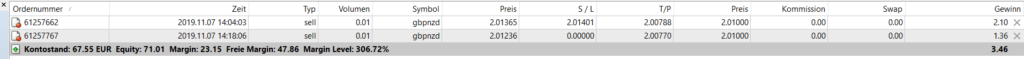

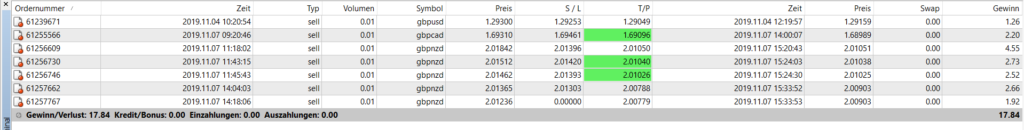

We started a small live account and traded the smallest lot size.

Just to demonstrate the potential of TPA combined with TPA Sessions.

But there is another reason:

Maybe we can help to change some mindsets. The step from a demo to live, mostly does not work, because when it comes to real money…..you know what I am talking about, right?

Simple trick to avoid another “kickback” in trading:

Use small money in a live account and get used to it, then get bigger and bigger.

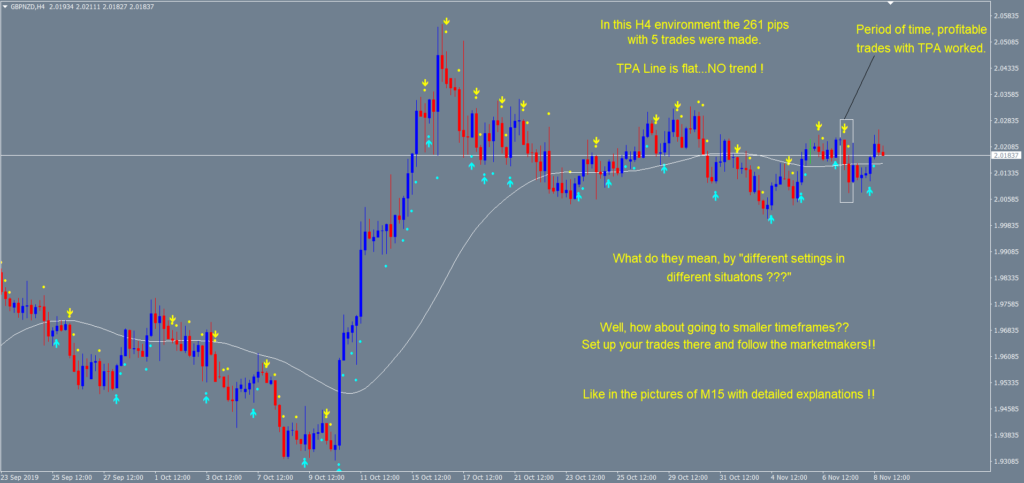

Ok, 5 trades (one reenrty missed), 261 pips gain on a 106 pips move, since the first entry. (Even more possible on M5, because of more signals in a smaller timeframe, but…)

22.72 % gain on the live account, that day, within 5 hours. Even more, if the one reentry wouldn`t have been missed.

A lot of pictures, but we are sure, you will gain something from them.

.

.

.

.

.

.

.

Last picture is the “account history”.

We really hope, todays trading session helps, to get a better understanding what TPA can do for you !

.

Here is the H4 overview, no trend, but “using different settings in different situations” or timeframes, means this….(out of many circumstances)…

.

.

Tuesday, 19th of November

Just in case you concentrate on this thread only, here is the answer about M5 settings from a respected customer.

It is very useful for TPA beginners AND TPA traders, who would like to know a good way to start all over with TPA, to follow the smart money with the best available tool:

Hello Hawey!

Thank you for renting probably the last indicator you ever need! 🙂

To assure yourself, that this is not a gag, we will help you in the best way we can. But please notice, that we are not allowed by law, to give you certain trading advice.

Especially after “certain people” got a bit nervous about TPA.

First you “could” observe TPA on your preferred time frames and pairs, without any filter. Just pure and clean TPA in the past days, maybe weeks.

All alerts off, to not get disturbed, watching ascending and descending signals. Major signals with arrows and follow up signals, reentries with dots. TPA Line should not be visible at first.

To “manage” so many profitable (as they never repainted or lagged) signals, you just have to understand: This is the past, and while I am trading during the day, they help me, finding profitable setups for the next hour, or hours.

Then you “could” draw trendlines and observe, how price

bounced off or broke them and see how TPA confirmed such

happenings, to get the next step further, studying the past to

learn for the future.

You will quickly realize, that TPA without any filters, or visible TPA Line, has no “waiting for turns of setted filter periods”. This is “True Price Action” of the marketmakers.

Once you are familiar with this fact, you “could” add the

TPA Line and make it visible, but not “active”, to study

the pure TPA signals moving along with TPA Line, period

21 and (important), other settings to compare!

The next step “could” be, to activate the TPA Line, to compare

(maybe on a second, identical chart), what it means:

Pure TPA and TPA with activated TPA Line.

This is the best way, to dive into TPA and discover trading possibilities (not only the additional reentries), you never saw before.

Now that you are in this stage, please try different settings, even with the dropdown menu for MTF function, to understand, how your pairs “behaved” in sessions with strong momentum, in sideways, quiet times and how you can match those to your trading style and time to trade during your day.

Please remember, we are not allowed to give you trading advice and that you are trading at your own risk !!!

Best Regards

The TPA team

.

Wednesday, 27th of November

Here is a comment of our respected customer and TPA trader, David:

I was trading as I normally did ie putting just one trade on when the signal appeared and crossing my fingers and holding my breath that it would work out for me. Generally speaking I would close the trade when I had made a small profit and miss out on the big moves because my risk exposure was too high – classic over leveraging.I was still happy with the signals even if my percentage return wasn’t as good as it could have been.

I have been using TPA and the sessions indicators for a month now and thought I’d share my user experience with anyone that is interested.

When I first bought the indicators I looked upon them as purely a way to get entry/exit signals in much the same way that all other indicators with arrows, dots etc are used. I used them this way on a demo account for a couple of weeks totally ignoring any money management protocols and over leveraging positions and doubled the account, I obviously had some drawdown but being a demo account that didn’t matter. I took the advice of the creators and traded only one pair GBPNZD (direction from H1 and entries taken from M15) which I had avoided in the past due to the volatility and spread, this was great on demo but not so great on a live account as drawdown can be vicious and extremely quick on this pair.

The lightbulb moment for me was when I started to use the signals as a money management tool which enabled me to stay in trades and capture a much bigger percentage of the move. Instead of taking a 2 lot position and hoping for the best I started to scale into trades with my first position being 0.2 lots which then allowed me to take up to 9 more positions at the same size if the pair ran in my direction. This is exactly what Guard talks about in one of his posts and it works absolutely brilliant when you use the TPA arrows and dots with the filter set to false which gives you all the entry points as the pair moves. If it doesn’t move in my direction I have a very small loss as I’m only trading 10% of my previous all in strategy but when it does go the way I anticipate then every time I add a trade the profits I have already accumulated mean even if that trade is a loser and the pair changes direction I have a cushion and never go into drawdown. What this has done is increase my confidence which enables me to take more trades and increase my percentage return without suffering any mental anguish.

The moral to my story is that you can use the indicators as stand alone entry/exit signals but if you use them as a money management tool and scale into trades you will be a lot more successful with a lot less stress.

Using this approach I am prepared for failure but ready for success.

Best regards